While having some infractions on your driving record can raise your costs, you can still discover cost effective non-owner cars and truck insurance policy coverage if you select a service provider like Highway Insurance policy. Obtain a Non-Owner Vehicle Insurance Quote Online Today Freeway Insurance supplies budget-friendly automobile insurance policy for non-car owners that you can rely on.

Non-owner vehicle insurance coverage is responsibility coverage for people that do not have their own automobile, however still require to drive occasionally. What is non-owner vehicle Insurance policy? If you have your automobile, you require to have an automobile insurance plan that covers you every time you obtain behind the wheel.

As a whole, you'll locate that non-owner car insurance coverage is a requirement in certain specific circumstancessuch as a prior history of DIUs. Uninsured vehicle drivers deal with rigid repercussions if they remain in a crash. One of the first things the other driver in a mishap will certainly ask you for is evidence of insurance coverage.

Due to the fact that chauffeurs can participate in a car-sharing service like Zipcar, or lease cars regularly, some insurance companies sell non-owner automobile insurance plans to use these individuals protection from obligation. Do you require a non-owner auto insurance coverage? If you do not own https://autoinsurancesouthhousto.z1.web.core.windows.net/ a car and aren't on someone else's automobile insurance plan, you 'd likely require non-owner cars and truck insurance coverage if you: Drive a buddy's auto typically, Take part in a car-sharing service, Lease cars and trucks regularly, Own a business whose employees drive personal cars for company functions, Required a SR-22 or FR-44 as a result of a DUI or serious web traffic offense, Offered your auto and will be without one for a short period of time, however still intend on driving frequently What does non-owner car insurance policy cover? If you remain in a crash when driving a pal's car and have non-owner vehicle insurance policy, what would certainly your plan cover? It will rely on your plan and also the state you stay in, yet for the a lot of component you'll find that liability insurance coverage is the main part of your policy.

You'll want to check your own plan carefully, but here are several of the protections that insurer may consist of in a normal non-owner auto insurance plan: Bodily injury If the other driver is hurt in a mishap, the insurance coverage tied to the owner of the car you're driving would start first.

The smart Trick of How To Get Cheap Non-owner Car Insurance - Moneygeek That Nobody is Discussing

There's been an issue with your vehicle driver's permit or you've been temporarily without a cars and truck, but now you're prepared to get back on the road - accident. What Is Non-Owner Automobile Insurance Policy? Non-owner car insurance coverage is a liability policy.

That stated, non-owner vehicle insurance coverage doesn't cover whatever., since those kinds of insurance coverage pay for repair services to the policyholder's automobile. And also given that you do not in fact own the lorry, you will not have any type of fixing costs.

Just How Does Non-Owner Auto Insurance Work? Non-owner automobile insurance includes a great deal of policies (just like every other type of insurance coverage). We're going to go through the most essential ones here, so buckle up, buttercup - vans. Non-owner cars and truck insurance only covers a single person. With most cars and truck insurance, you pay for protection on a certain automobile.

That means your name is on the plan, and your insurance just covers you. auto insurance. If you borrow your sibling's auto and allow your friend drive it, your policy will not cover any type of accidents that take place while your good friend is behind the wheel. Your liability limitation needs to be greater than the one on the owner's primary policy.

Your non-owner insurance coverage is implied to cover damages that exceed what the main policy coversand that suggests your liability restriction has to be greater. Allow's say your friend has the state minimum of $30,000 in obligation insurance coverage.

The Of What Is Non-owner Car Insurance? - The Zebra

Your friend's insurance coverage covers $30,000 and yours covers the next $20,000 for an overall of $50,000. Remember, the higher your responsibility limit, the much better protected you are.

You may have a car of your very own and still require this insurance coverage. And somebody that does not own an automobile and doesn't drive much might not need it. It's important to make certain this is the right coverage for you prior to you purchase it. laws. You're more than likely to need non-owner auto insurance policy if you: We currently chatted regarding why you need non-owner vehicle insurance if you borrow a cars and truck, so we won't cover that again.

If that's what you're doing, you need to be listed on your relative or flatmate's insurance policy. From an insurance policy point ofview, renting an automobile works a whole lot like obtaining one due to the fact that the rental company already has some coverage on the cars and truck. They'll additionally sell you extra coverage. Yet if you rent out usually sufficient, lugging your own non-owner automobile insurance policy could actually be cheaper than the obligation insurance you pay for at the automobile rental counter.

Car-sharing services usually guarantee their cars and trucks with the state minimum quantity of insurance coverage. So you'll want the additional insurance coverage in situation of a really bad accident. Some drivers need to file these forms by state or court order to show that they have at least the state minimum obligation insurance coverage.

Allow's claim you offer your auto to pay off some debt. You intend to utilize trip sharing and public transportation momentarily, as well as you're saving approximately pay cash money for a car next year. It could be an excellent concept to obtain non-owner automobile insurance coverage in the meanwhile to avoid paying higher costs when you get that wonderful, debt-free automobile later on.

The Facts About Non-owner Car Insurance - Getting Car Insurance Without A Car Revealed

And as much as we 'd enjoy to offer you a certain response just for your circumstance, we can't. affordable car insurance. There are a lot of variables that can affect the expense for non-owner car insurance policy, like your previous driving document and also just how high your deductible is (or if you even have one).

Just the term "car insurance coverage" alone suffices to imply that a cars and truck is required to acquire cars and truck insurance policy, however that is not true. Several chauffeurs are shocked to discover that you can get car insurance also if you do not possess a lorry. Non-owner vehicle insurance is a specialized sort of auto insurance policy developed for those vehicle drivers that do not possess a lorry however still sometimes drive on U.S - laws.

auto insurance cheap car car insurance affordable

auto insurance cheap car car insurance affordable

Non-owner auto insurance policy provides responsibility insurance coverage if you create a mishap. It can help pay for: for the vehicle driver as well as guests in various other lorries entailed in the crash. you create to somebody else (credit score). if someone sues you for causing the mishap. Relying on where you live and also the insurance firm, non-owner vehicle insurance coverage might likewise give: (UM/UIM).

If you have a significant driving offense on your record, such as a DRUNK DRIVING, your state might need you to have an SR-22 or FR-44 form. Your insurance provider submits the kind on your part to reveal that you have at the very least the minimum amount of insurance protection your state calls for.

Not all conventional insurance policy companies offer this kind of protection, and also some just provide it to existing customers. Some insurers that might supply non-owner vehicle insurance policy consist of: Geico State Ranch Progressive Nationwide. low cost.

Types Of Car Insurance Coverage - The Facts

This indicates that it pays the expense of problems after a crash that you create. This consists of:: Covers clinical bills and lost earnings for other chauffeurs as well as their guests: Covers the cost of problems to other events' lorries and also residential or commercial property Responsibility protection does not spend for problems to your own individual, guests or automobile.

0 We at the Home Media examines team rate USAA equally as extremely as Geico, and for much of the very same reasons. The only disadvantage to USAA is that it is not readily available for all vehicle drivers - low-cost auto insurance. In order to be qualified for a policy with USAA, you have to be an armed forces participant or have a relative with a USAA account.

Right here are the factors our scores take into account: Cost (30% of overall rating): Car insurance coverage rate price quotes generated by Quadrant Information Solutions and price cut possibilities were both taken right into consideration. Insurance coverage (30% of overall rating): Business that provide a selection of selections for insurance policy coverage are a lot more likely to satisfy customer demands.

Load full table of contents You could be happily amazed at just how much less expensive a non-owner cars and truck insurance policy quote is compared to a primary automobile insurance coverage policy, also. To discover the very best alternative, use automobile insurance comparison purchasing and also broker application Jerry. For assistance understanding as well as interpreting automobile insurance policy quotes online for a non-owner plan, kept reading. It's not the right plan for individuals who cope with the vehicle owner as well as must be contributed to the cars and truck's primary policy. You additionally do not need non-owners car insurance policy if you occasionally drive a firm cars and truck however only for organization. Generally, the company's plan covers employees who drive company automobiles for professional reasons.

Just how does non-owner automobile insurance job? Let's say you obtain right into an accident while driving a friend's cars and truck. If you have a non-owner vehicle insurance coverage policy, it will kick in if your own policy limitations are better than your close friend's.

How Car Insurance - Start A Free Auto Insurance Quote - Geico can Save You Time, Stress, and Money.

vans cheaper car insurance auto cheapest

vans cheaper car insurance auto cheapest

Numerous of these firms provide some kind of protection to their momentary users, however you ought to verify to make certain you're comfortable with the level of protection used. You can acquire rental car insurance coverage from the rental firm for roughly $20 per day.

A non-owner policy is a kind of car insurance for people who do not own their own cars, yet that still drive periodically. If you frequently borrow another person's cars and truck, usage car-sharing services or rent out lorries, or if you simply intend to maintain your protection to avoid a gap, you must consider non-owner insurance. cheapest car.

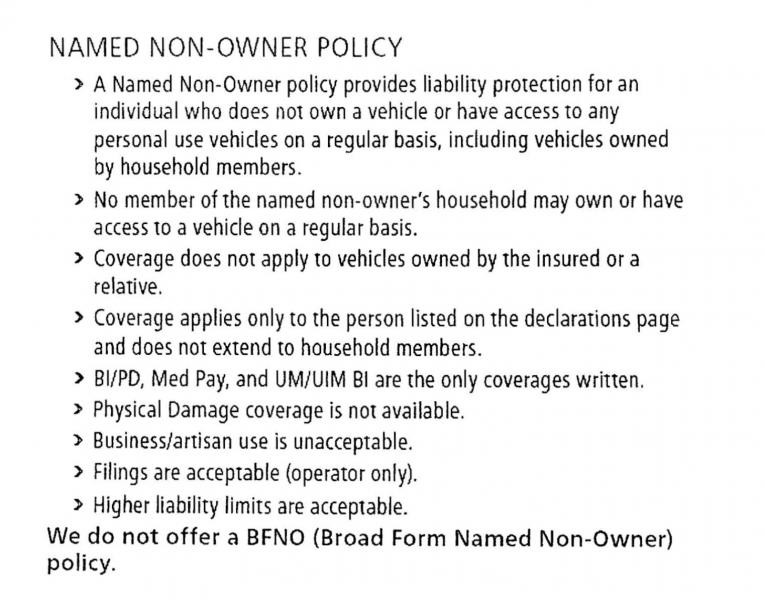

What is non-owner vehicle insurance? Non-owner cars and truck insurance coverage also called non-vehicle proprietor insurance coverage or a named non-owner plan covers drivers that do not have their very own lorries, however who drive often. credit. With a non-owner plan, drivers without a cars and truck can obtain insurance policy that gives bodily injury and home obligation (BIPD) coverage.

cheaper auto insurance affordable cheaper car cheap insurance

cheaper auto insurance affordable cheaper car cheap insurance

There's not much area to personalize non-owner cars and truck insurance, yet drivers can add greater than the minimum necessary quantity of obligation coverage in their state - cheaper car. Find out more concerning what a full-coverage vehicle insurance plan safeguardsWho requires non-owner vehicle insurance coverage, Non-owner car insurance is best for people who don't have an automobile but still drive frequently.

suvs car credit vehicle

suvs car credit vehicle

You desire to keep coverage even while not driving, Insurance coverage business generally raise prices for chauffeurs that have had a gap in their vehicle insurance policy coverage. Non-owner auto insurance might be a great method to assist you stay clear of a lapse as well as higher cars and truck insurance prices in the future.

10 Easy Facts About Your Guide To Non-owner Car Insurance Explained

You need an SR-22 type, If you're classified a risky chauffeur as well as your permit is withdrawed, you might be needed to obtain an SR-22 or FR-22 kind prior to your license is renewed. If you do not own an auto, getting non-owner SR-22 insurance would allow you to restore your permit. An SR-22 form indicates to the state that you bring at the very least the minimum needed quantity or responsibility insurance policy.

Usually, the expense of automobile insurance coverage rises for motorists who need to get an SR-22, due to the fact that they're perceived to be a lot more risky to cover. insurers. However, just as a non-owners plan is cheaper than conventional car insurance coverage, the expense of an SR-22 type will be less costly for drivers without a car than those who bring normal insurance policy policies.

If you fall right into among the adhering to teams, a non-owner policy may not be best for you: You only obtain a cars and truck coming from somebody you deal with: You do not require to buy a different non-owner plan if you live with the individual whose auto you obtain (cheaper). You should, nevertheless, be listed on their policy as an allowed driver.

You hardly ever drive or don't intend to possess a vehicle in the future: While non-owner vehicle insurance can aid you avoid a protection gap when you're not driving, you do not need a plan if you never ever prepare to own a car again. car insured. If you don't plan to own a car, you won't require insurance policy and won't experience higher prices in the future from being uninsured.

Some companies only enable existing insurance policy holders to acquire coverage. Others may only supply non-owner auto insurance policy in certain states. Unlike a normal plan, you won't be able to find a quote for non-owners cars and truck insurance coverage online (prices). Instead, you'll need to contact a rep over the phone to obtain insurance coverage. Prior to purchasing insurance coverage you'll possibly have to give some personal information, including evidence of identification, your driver's permit number, and an approach of settlement.

The Single Strategy To Use For Non-owner Car Insurance

Policygenius has actually validated that the adhering to big insurers do supply non-owner plans: Prior to you acquire, it's additionally a good suggestion to consult a potential insurer about what they think about a "non-owned vehicle" as well as what comprises "regular use. cheaper." Some insurance firms, for circumstances, will not expand a non-owner automobile insurance coverage to a person that deals with an actual cars and truck proprietor.